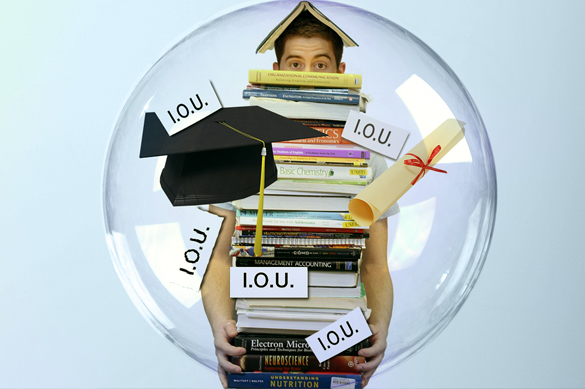

More than 500,000 federal employees participate in the Student Loan Forgiveness Program, targeted for elimination in the administration’s fiscal 2018 budget proposal. If you’re one of those participants, the cuts are very personal.

This program makes it possible for lower and moderate income students who qualify to choose a career helping others through public service because their loans will be paid off in a decade. It benefits the federal government by helping to attract and retain highly-skilled employees who incur significant debt for their education, but choose public service over the more lucrative private sector.

For many, like Chapter 34 (IRS Pittsburgh) member Michael Hale II, the program played a deciding factor in their decision to join the federal government.

“Many federal employees could make more money in the private sector, but we choose to serve the American people and our country in the capacity of civil servants,” said Hale, a contact representative at the IRS Pittsburgh call site. “We are proud to work for the American government even if the pay is not on par with the private sector.”

Immediately after the budget proposal was announced, National President Tony Reardon wrote to Education Secretary Betsey DeVos objecting to cutting the loan forgiveness program, explaining its benefit to NTEU members and asking questions.

The loan forgiveness program allows public sector employees to apply to have their student loans canceled after they have made 120 qualifying monthly payments, or 10 years of payments. Put in place 10 years ago with bipartisan legislation, the first of the approved enrollees are scheduled to have their loans forgiven in October of this year.

For participants like Hale, whose monthly student loan payments exceed his car payments, getting to the loan forgiveness date is a big deal.

“Each month, I mark off one more payment toward the 120 payments needed for the forgiveness,” said Hale, who joined the federal government in October 2010. “I have put a lot of things in my life on hold until I can have my student loans forgiven.”

With the annual appropriations process underway on Capitol Hill, NTEU will continue to strongly oppose the cuts and emphasize how ending the program hurts both agencies and federal employees.

“This program needs to be kept in place not only for those of us who have planned our financial future on a program that was promised to us upon our hire, but as well to attract new, educated employees to the federal workforce,” said Hale.